Manufacturing buyers go digital long before sales get involved

Table of contents

- The modern manufacturing buyer journey is digital first

- Traditional industries, modern buyers

- Why sales teams enter the buying process later than ever

- Where manufacturing marketing often falls behind

- Digital visibility is now a revenue issue

- How manufacturing marketing leaders need to adapt

- How Oktopost helps manufacturing marketers influence buyers earlier

For decades, manufacturing sales followed a familiar rhythm. Trade shows, in-person meetings, plant tours, and long-standing relationships did most of the heavy lifting. Marketing supported sales with brochures, spec sheets, and occasional campaigns, while deals were largely driven offline.

That rhythm has quietly changed.

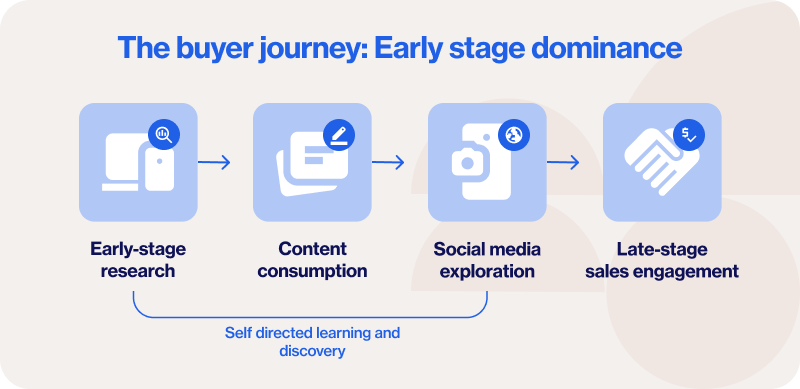

Today, manufacturing buyers make most of their decisions long before they speak to a salesperson. Research, comparison, shortlisting, and early validation now happen across digital channels, from search engines and websites to content platforms and professional networks. By the time sales gets involved, buyers already have opinions, expectations, and a clear sense of which vendors feel credible.

It is important to be precise here. When we talk about a digital-first buyer journey, we are not talking about social media in isolation. Digital marketing includes websites, search, content, data, and automation. Social media is one of the most influential layers within that ecosystem, because it connects information to people and turns research into trust.

This distinction matters, especially in manufacturing.

Buyers are not replacing traditional research with social media. They are using social platforms to validate what they find through search, content, and peer recommendations. LinkedIn posts, employee perspectives, and visible expertise often become the deciding factor that separates credible suppliers from everyone else.

In practice, manufacturing buyers are typically 60% or more of the way through their buying journey before a form fill or a sales conversation occurs. During this time, buyers research independently, compare suppliers, and align internally on which vendors feel credible. If a brand is not visible where that research takes place, it is effectively invisible when decisions are made.

This shift is not theoretical. It is already reshaping how manufacturing companies win or lose deals.

The modern manufacturing buyer journey is digital first

Across B2B industries, research consistently shows that buyers complete most of their decision-making digitally before engaging sales. Gartner describes today’s B2B buying journey as non-linear and largely self-directed, with buyers gathering information independently across multiple channels before ever speaking to a vendor.

Google’s research into B2B purchasing behavior reinforces this shift. According to Google, more than half of B2B purchase decisions are influenced by digital content, and search plays a central role in early-stage research.

For manufacturing organizations selling complex products with long sales cycles, this matters deeply. Buyers are under pressure to reduce risk. They want to understand options, evaluate credibility, and build internal alignment before committing time to a sales conversation.

If your brand does not appear during that research phase, you are not part of the decision set when it matters most.

Traditional industries, modern buyers

Manufacturing is often described as a traditional industry, but its buyers operate in a modern environment. Decision-makers are influenced by the same digital behaviors shaping every other B2B sector.

Millennials and Gen Z now make up a growing share of both the manufacturing workforce and buying committees. McKinsey highlights that younger buyers expect digital-first experiences and increasingly influence purchasing decisions, even in complex B2B environments.

Even experienced buyers who value long-term relationships now expect digital proof before engaging. They look for consistency, expertise, and relevance across channels. A limited or outdated digital presence creates friction and uncertainty, regardless of how strong a sales relationship may be.

Recommended for further reading

Why sales teams enter the buying process later than ever

Sales teams today are meeting buyers at a much later stage of the journey. By the time a buyer reaches out, they have often already:

- Defined the problem internally

- Researched solution categories

- Shortlisted credible vendors

- Validated options through content and professional networks

LinkedIn’s B2B research shows that professional networks play a critical role in validation and trust building, particularly when multiple stakeholders are involved.

This changes the role of sales. Conversations are no longer about basic education. They are about confirming decisions that buyers have already made.

Marketing now carries much more responsibility for shaping those early perceptions.

Where manufacturing marketing often falls behind

Many large manufacturing organizations still rely heavily on trade shows, sales-led outreach, and static websites. These tactics still matter, but they no longer cover enough of the buyer journey.

Manufacturing buyers are not waiting for events to learn. They are actively searching year-round. They are comparing suppliers who consistently publish, are active on LinkedIn, and empower employees to share expertise publicly.

When marketing does not reflect this reality, the risks compound:

- Buyers discover competitors first

- Brands feel harder to evaluate

- Sales conversations start defensively

- Marketing struggles to prove revenue impact

Digital visibility is now a revenue issue

This shift is not about trends. It is about revenue protection and growth.

Research consistently shows that manufacturing companies that invest in digital marketing achieve stronger outcomes. Oktopost’s analysis shows that manufacturers who invest in digital channels, including content and social media, report greater success and improved inbound performance.

Digital visibility influences awareness, confidence, trust, and deal velocity. Familiarity reduces perceived risk. Reduced risk accelerates decisions.

Marketing’s role is no longer to support sales from the sidelines. It actively shapes when and how opportunities are created.

How manufacturing marketing leaders need to adapt

To adapt, manufacturing marketing teams need to rethink where they invest.

First, they must show up earlier. Educational content should address buyer questions before sales engagement.

Second, they must treat search, content, and social as connected rather than separate. Social media amplifies digital content and adds human validation to research.

Third, marketing and sales must align around buyer behavior. Sales should understand what buyers consume digitally. Marketing should understand what buyers ask once sales are involved.

Digital-first does not mean digital-only. It means digital-aware.

How Oktopost helps manufacturing marketers influence buyers earlier

Oktopost helps manufacturing organizations adapt to the modern buyer journey by turning social media into a measurable, strategic extension of their digital marketing strategy.

With Oktopost, teams can manage a LinkedIn-first presence, empower employees to share expertise in a structured way, and measure how social activity influences awareness, engagement, and pipeline. Oktopost supports alignment between marketing and sales by connecting social data with the broader B2B tech stack.

Manufacturing buyers are already researching digitally. Oktopost helps ensure your brand is part of that research.

Request a consultation with a marketing expert to see how leading manufacturing organizations influence buying committees before sales get involved.